Onchain Explained

Onchain analytics is all about analyzing blockchain activity — empowering traders, investors, and researchers with actionable insights.

Written By Nansen Intern

Last updated 8 months ago

Onchain data provides transparency into wallet behaviors, token flows, and protocol performance. Whether you're tracking whale wallets, evaluating a protocol's health, or detecting suspicious activity, onchain analytics is the key to making informed decisions.

What is Onchain Analytics?

Onchain analytics involves collecting and interpreting data directly from blockchains to gain insights into cryptocurrency transactions, market trends, and user behaviors. Every blockchain transaction—whether it’s transferring tokens or interacting with a smart contract—leaves a traceable record.

Onchain analytics tools aggregate this data, allowing users to monitor real-time and historical activity.

Key features of onchain analytics include:

Transaction Tracking: Analyze where funds are moving, including inflows and outflows to exchanges.

Wallet Profiling: Study the behaviors of top wallets (often called "smart money").

Token Distribution: Visualize how tokens are allocated among wallets or protocols.

For example, monitoring a whale transferring significant funds to an exchange could signal a potential market move, while tracking liquidity trends in a DeFi protocol might reveal new opportunities.

Why is Onchain Analytics Important?

Onchain analytics is essential for several reasons:

Transparency:

Blockchain technology is inherently transparent, but raw data is complex. Onchain analytics tools like Nansen simplify and visualize this data, making it accessible to everyone.

Actionable Insights:

Instead of relying solely on price charts or off-chain metrics, onchain analytics provides deeper insights into market behavior. For instance, understanding how whales are positioning their assets can inform your trading strategy.

Fraud Prevention and Risk Mitigation:

With onchain analytics, users can identify signs of fraud, such as rug pulls, token dumps, or abnormal activity in DeFi protocols. This early detection helps protect funds and mitigate risks.

Strategic Edge:

For both long-term investors and short-term traders, onchain analytics offers an edge by uncovering trends before they appear in price data.

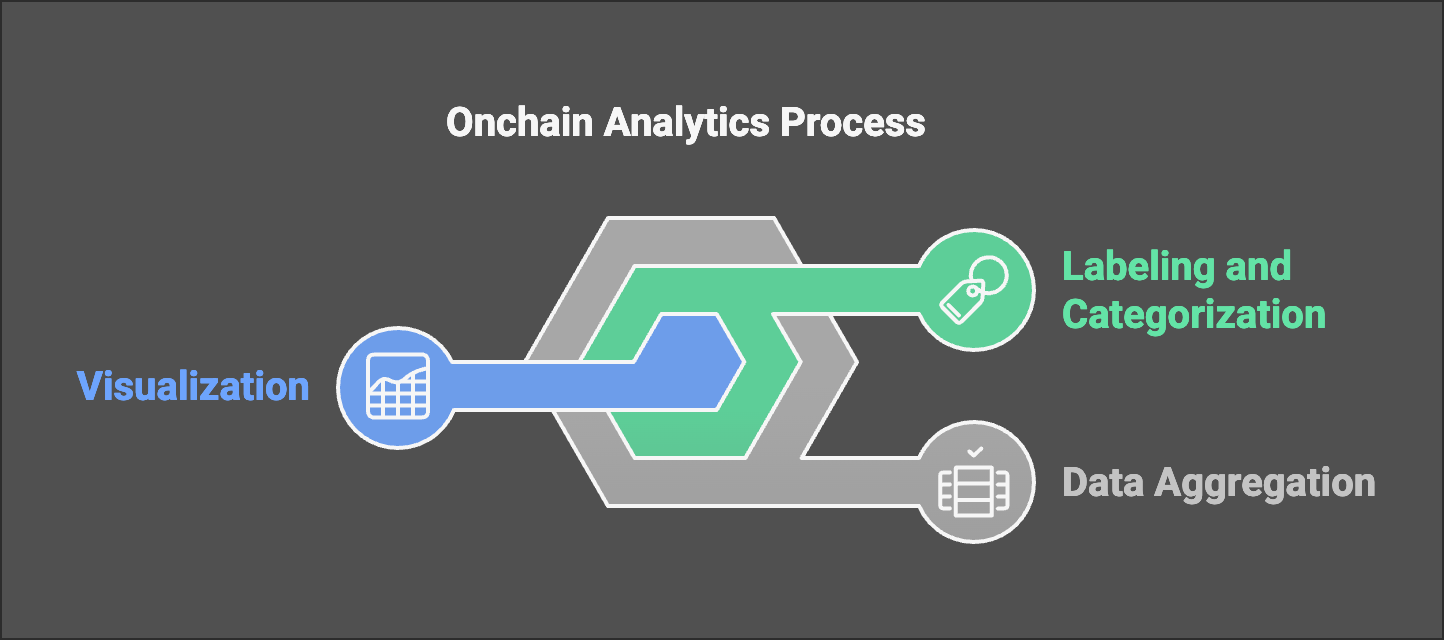

How Does Onchain Analytics Work?

Onchain analytics tools gather data directly from blockchains, process it, and present it in a user-friendly way. Here’s how the process works:

Data Aggregation:

Blockchains like Ethereum, Solana, and BNB Chain publish data as part of their public ledger. Onchain analytics tools fetch this raw data, including transaction details, wallet balances, and contract interactions.

Labeling and Categorization:

Tools like Nansen enhance raw data by labeling wallets and categorizing them (e.g., exchanges, funds, or whales). For example, Nansen tags wallets based on activity patterns, making it easier to identify "smart money" versus regular retail wallets.

Visualization:

Dashboards and charts convert complex data into digestible insights. For instance, you might see a chart showing the daily flow of stablecoins into a specific protocol or a breakdown of token holdings among top wallets.

Use Cases for Onchain Analytics

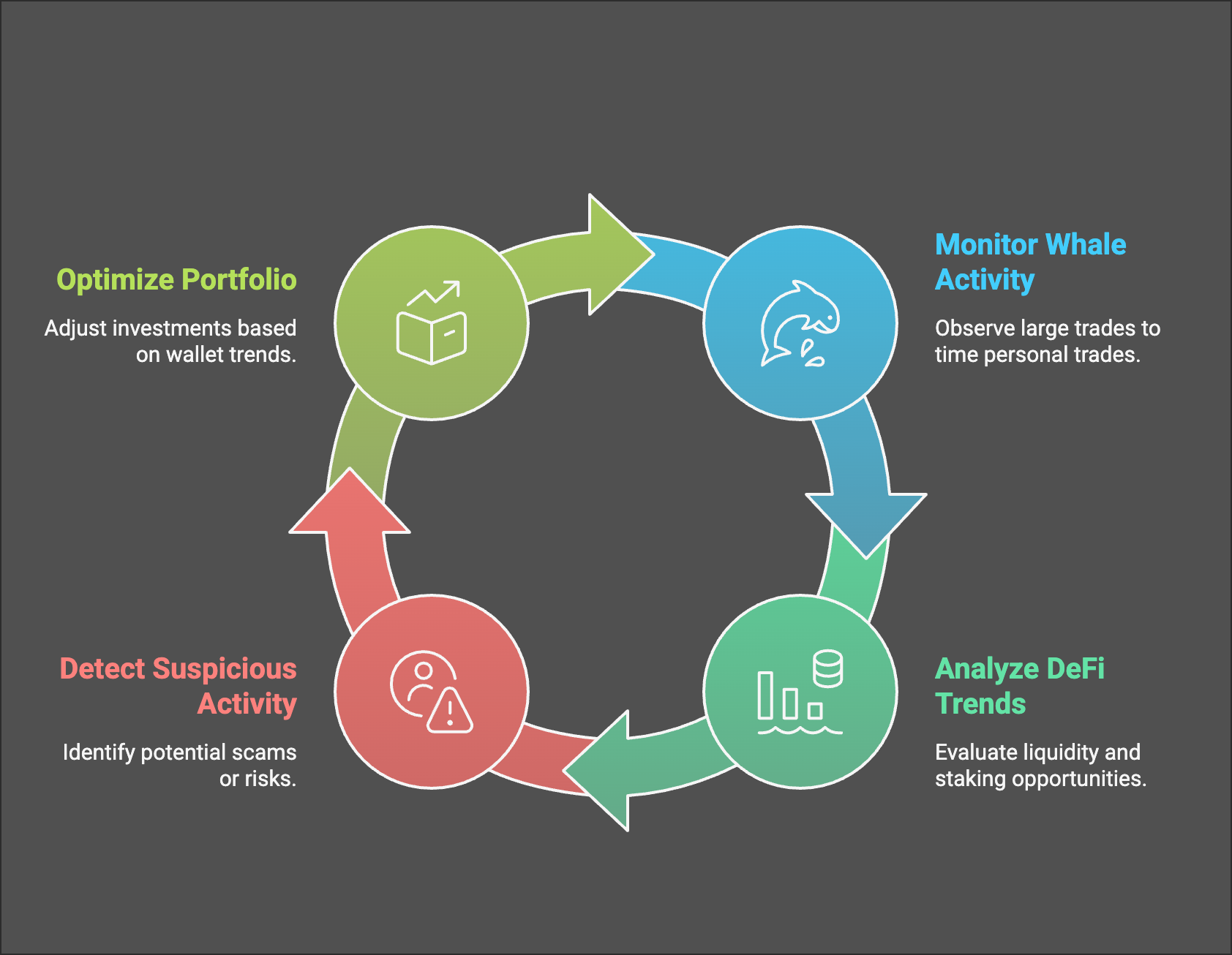

Trading Strategies:

Monitor whale activity to understand when significant players are entering or exiting a position. This can help you time your own trades more effectively.

DeFi Analysis:

Evaluate liquidity pool trends and staking opportunities by analyzing protocol activity. You can identify where capital is flowing and adjust your strategy accordingly.

Risk Management:

Detect signs of suspicious activity, such as a large number of tokens being minted or dumped, to avoid scams or poorly managed protocols.

Portfolio Optimization:

Track your own wallet or monitor trends in similar wallets to optimize your portfolio performance.